Vitaly Poplavets, VIG Asset Management

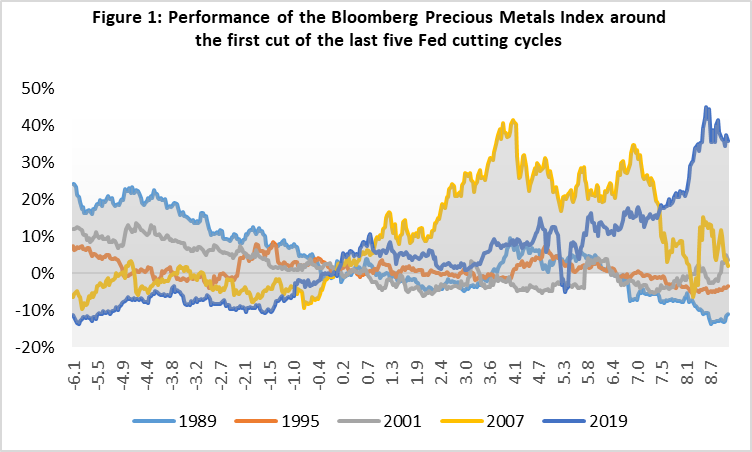

According to the historical data, we are experiencing a time of the cycle where precious metals, gold specifically, perform positively. The Bloomberg Precious Metals Index (BCOMPR) is the only major commodities sub-index that posts positive returns over the nine months following three of the last five Federal Reserve rate cut periods (Figure 1). Based on the consensus view, a majority of economists now see the Fed is set about an easing cycle this month (against November previously expected) and cutting rates thereafter until the Fed funds rate returns to neutral. While the base case doesn’t call for the US recession, a much sharper weakening in US labour markets still considered as a risk. Were this to realise, pushing a much intense and quicker cutting cycle by the Fed, there is the potential for rallies in gold to become more accelerated, as it was seen over the two most recent cutting cycles (2007 and 2019) which were followed by a recession.

(Y): Index, 0% = day of the first FOMC cut. (X): months around the first FOMC cut.

Source: Bloomberg

It should be noted that gold’s price moves over the last few years have been far from typical and the upcoming rate cycle could also be quite unusual given the potential policy changes following the US election in November this year.

Even if the Fed easing cycle comes with uncernainty given potential post-election US policy changes, gold sits in a good position to rally. Structurally supporting factors such as US fiscal deficit concerns, central bank reserve diversification amid decrease in the U.S. Dollar holdings, inflation fears, and boiling geopolitical risks have all added to gold’s strong performance in the last year. Gold’s demand drivers have faded in recent months with Chinese physical demand slowing currently while financial participants re-engaging again and western ETF demand beginning to gain momentum. The driver of the next legs higher in gold might be fixed primarily on stronger inflows from the financial markets, where holdings of ETF ounces still remain around 20% lower the recent peak.

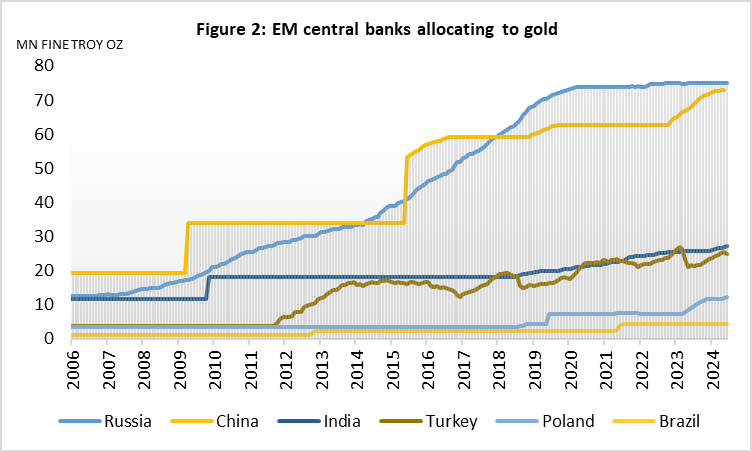

Moreover, during the year, central bank purchases of gold have surged, especially among Emerging Markets. China has been in the front seat, with some sources arguing that the People’s Bank of China continued to buy gold even after an announcement that purchases had been halted. China is not the only buyer. Russia, Turkey, and Poland have added to their holdings recently (Figure 2).

Source: Bloomberg

With little doubt, Asian demand accounts for the large share of gold purchases over the year. Besides FX reserves, China’s gold purchases indicates its goal to internationalize the country’s currency through the Shanghai gold exchange. This might be another driver of gold prices. Private demand from Japanese investors has also been important. The allure of the yellow metal in the context of rising inflation and a dovish Bank of Japan (BoJ) helped increase Japanese demand 15-times in a relatively short period of time. As the BoJ has become more hawkish, Japanese gold purchases have cooled amid Chinese demand is gaining momentum.

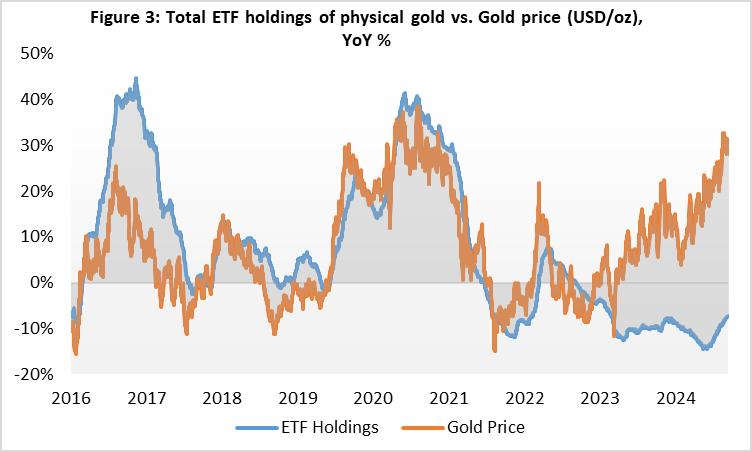

The last but not least, ETF holdings of physical gold have had a consequential impact on the direction and degree of gold price performance. This relationship has become diverged over the year (Figure 3) as ETF demand vanished but was more than made up for by physical demand from Asia. While the pace of rate cuts by the Federal Reserve might make gold more attractive from a real interest rate perspective, retail attention seems focused on the more euphoric stock market. Unless inflationary concerns grow within the context of interest rate cuts, retail attention will likely remain skewed toward equities rather than gold. This might suggest the slower pace of price appreciation for gold.

Source: Bloomberg

“The authors who contributed to this article accept no responsibility whatsoever for any investment decisions made on the basis of their writings or for the consequences thereof, or for any omissions or inaccuracies in the information contained on this website. The views expressed in this article are the subjective opinions of individuals and do not constitute investment analysis or recommendations.”