What happened in the last month?

In focus: U.S. growth and the Federal Reserve

Although headline data suggest that the U.S. economy is performing well, the labour market is showing signs of weakness. Gross domestic product (GDP) – the total value of goods and services produced in the U.S. economy – expanded by 4.3% in the third quarter of last year, and according to the Atlanta Fed’s GDPNow estimate, growth may have exceeded 4% again in the final three months of the year.

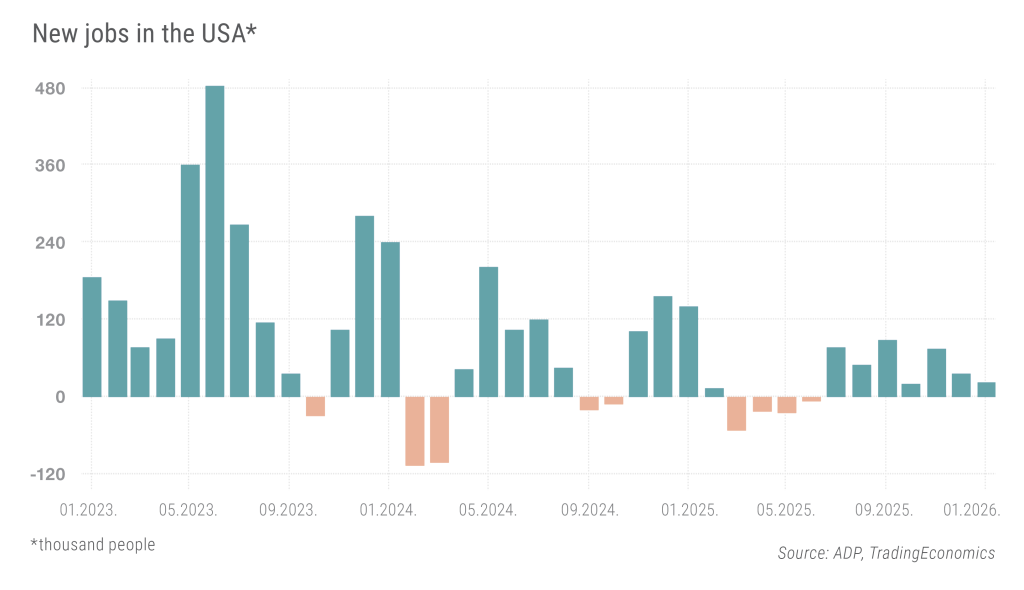

In contrast, employment figures have disappointed. According to the ADP survey, private-sector employers created just 22,000 new jobs in January 2026 – below the downwardly revised December figure of 37,000 and well short of market expectations of 48,000. The services sector, the main engine of economic growth, shed 57,000 jobs, while the politically sensitive manufacturing sector lost a further 8,000 positions. Manufacturing employment has now been declining every month since March 2024.

Overall job creation slowed markedly in 2025: the private sector added only 398,000 jobs over the year, compared with 771,000 in 2024. This trend strengthens the case for interest rate cuts by the Federal Reserve, which would support both companies and households through lower borrowing costs. Such a move is likely to be backed by the incoming Fed Chair, Kevin Warsh, who is set to take office in May and was nominated by Donald Trump, a long-standing advocate of lower interest rates.

The current Fed Chair, Jerome Powell, remains more cautious. In January, the federal funds rate was left unchanged within the previous target range of 3.5% – 3.75%, reflecting the central bank’s continued focus on keeping inflation under control.

Equity market news

Global equity markets have reached a new all-time high, with the MSCI World Index up nearly 20% over the past 12 months. However, the latest phase of the rally has been led primarily by markets outside the United States. Another notable shift has been a significant rotation across sectors.

Materials and energy stocks have outperformed, while technology and financials – previously investor favourites – have lagged behind. Within just a few weeks, a historically large rotation towards small-cap equities took place, resulting in well above-average returns in January. While the broader S&P 500 index was essentially flat over the month, the small-cap Russell 2000 delivered gains of around 6-7%.

The former market darlings, collectively referred to as the “Magnificent Seven,” are no longer moving in unison. Chipmaker Nvidia and Alphabet, Google’s parent company, remain investor favourites, while shares of Meta Platforms and Microsoft have come under pressure amid concerns about excessive investment in artificial intelligence.

South Korea’s KOSPI index, by contrast, has emerged as a clear beneficiary of the AI boom. Driven by a sharp rise in memory chip prices, the Seoul stock market surged by 20% in January.

Bond market news

As previously highlighted, monthly employment reports continue to point to structural weaknesses in the U.S. labour market. This provides a strong rationale for the Federal Reserve to begin cutting its policy rate once the new Fed Chair takes office in May.

However, rate cuts in an inflation environment that remains above target (2.7% versus the 2% objective) could lead to a further steepening of the U.S. yield curve. Based on his recent statements, Kevin Warsh – widely regarded as a Wall Street insider with extensive central banking experience – does not support lowering long-term yields through renewed purchases of longer-dated government bonds by the Fed.

In his view, artificial intelligence will significantly enhance corporate efficiency over the longer term, helping to reduce costs and, ultimately, ease price pressures. This backdrop is not supportive for bond markets, suggesting a gradual depreciation of U.S. Treasury bonds with a 10-year maturity.

At the same time, the U.S. dollar’s weakening trend over the past year has improved the relative attractiveness of emerging market bonds. With an average yield premium of around 2.5% per annum, these instruments continue to offer a compelling carry opportunity.

Alternative investments news

During the past weeks Gold prices fell by more than 7% in a single day, dropping below USD 5,000, following news of the imminent appointment of the Federal Reserve’s new Chair. Kevin Warsh, a proponent of a more hawkish monetary policy stance, reassured investors with his nomination. The U.S. dollar strengthened on the news, while safe-haven precious metals – gold as well as silver- retreated sharply after reaching record highs just a day earlier. Despite the correction, gold has still delivered gains of over 10% so far this year.

Gold was not the only strong performer this year in the commodities space. U.S. natural gas prices nearly doubled within a few days, driven by exceptionally cold weather conditions across the country.

What can we expect in the coming period?

Investment clock

The VIG Asset Management Global Investment Clock forecasting model that uses forward-looking indicators to assess the short-term economic cycle. At present, the model is pointing towards a recovery phase. At the same time, outlooks differ noticeably across regions.

In the United States, economic performance remains strong, with GDP growth expected to exceed 4%. Although consumer price inflation, at 2.7%, is above the Federal Reserve’s 2% target, overall price dynamics remain manageable. Energy prices are subdued—oil prices hovering just above USD 60 per barrel are close to a five-year low—while more pronounced price pressures are visible primarily in services. Taken together, conditions are increasingly supportive of interest rate cuts.

In Europe, corporate earnings growth is expected to accelerate compared with previous years. These trends support a constructive outlook for equity markets. At the same time, stock market performance is increasingly driven by sectors typically associated with the expansion phase of the cycle, such as materials and energy.

China, however, continues to lag behind. According to a Reuters poll, GDP growth may slow from 5% last year to 4.5% in 2026.

Tactical Asset Allocation

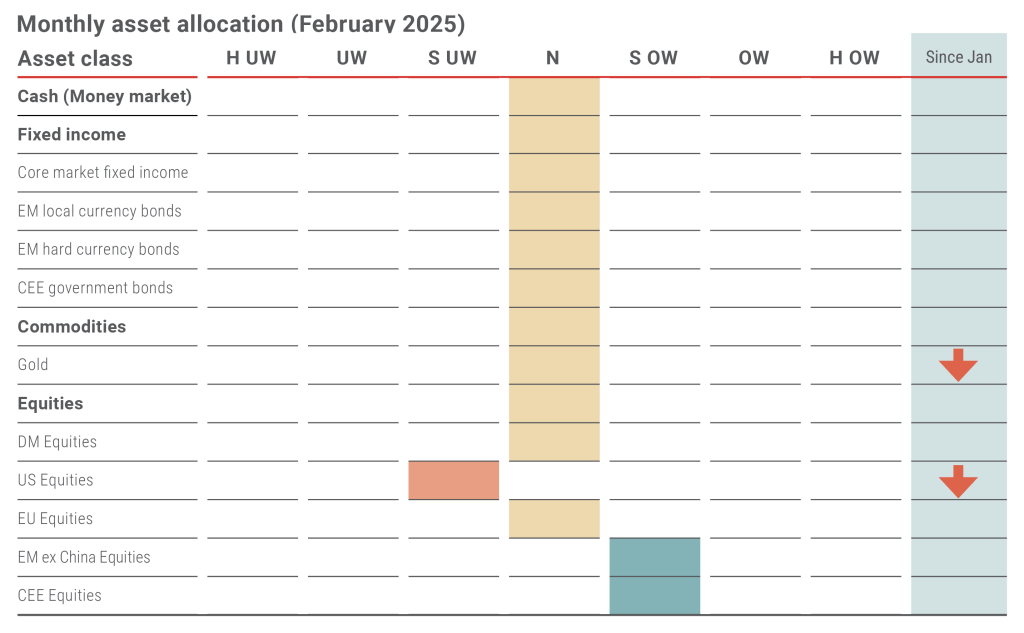

In line with the latest macroeconomic and capital market trends, we have made adjustments to our asset allocation. Optimism in U.S. equity markets appears excessive, prompting us to underweight. At the same time, commodities may perform well during the recovery phase of the economic cycle. Following the sharp surge in January, however, gold prices may be due for a short-term correction.

An attractive opportunity: commodities

The pickup in global economic growth and a gradual shift away from the U.S. dollar are both supporting higher exchange-traded prices of precious metals. The recent commodities rally has been driven primarily by precious metals and natural gas. Gold prices reached the USD 5,500 level, while natural gas prices doubled in less than a week due to a cold snap in the United States.

Although gold rose by 23% in January before correcting on news related to U.S. economic policy, it may still represent an attractive long-term investment opportunity below USD 5,000 per ounce.

Caution warranted on U.S. equities

Our VIG Asset Management sentiment indicator points to excessive investor optimism. Positioning signals are becoming increasingly concerning. According to the Bank of America Fund Manager Survey (FMS), conducted in January among 227 institutional fund managers overseeing a combined USD 646 billion in assets, investor sentiment is at its most optimistic level since July 2021.

Global growth expectations have surged, cash levels have fallen to a record low of 3.2%, and hedging against equity market corrections is at an eight-year low. The widely followed bull–bear indicator stands at 9.4 out of 10, with readings above 8 typically signalling extreme optimism and elevated risk. Against this backdrop, it may be prudent to reduce exposure by taking partial profits.

The weights indicate the evaluation of the respective country, region, and asset class, providing a basis for portfolio managers in structuring portfolios and establishing positions, thus helping to capitalize on market opportunities.

Weights:

- Strongly underweight

- Underweight

- Slightly underweight

- Neutral

- Slightly overweight

- Overweight

- Strongly overweight

Changes – change compare to the the previous month

The table was prepared based on our investment clock and quadrant modell**.

Focus fund: VIG MoneyMaxx Emerging Market Absolute Return Investment Fund

The Fund may serve as an effective investment vehicle for capturing the expected above-average performance of emerging markets. Through active portfolio management, it selects the most attractive investment opportunities both across and within asset classes. With a high equity allocation – exceeding 50% – the Fund is well positioned to participate meaningfully in equity market upswings.

The portfolio features a pronounced overweight in emerging markets, allowing it to benefit from the ongoing reallocation within global equity markets. In our view, equity markets outside the United States are likely to be the main drivers of performance this year, with European growth prospects gradually converging towards those of the U.S. At the same time, companies operating in emerging markets are expected to deliver growth rates up to twice as high as those in developed economies.

Latin American and South African companies – and, by extension, their equity prices- stand to benefit from rising commodity prices, while Asia (particularly South Korea, Malaysia and Taiwan) is supported by rapidly expanding orders for IT manufacturing firms. Beyond the U.S., markets globally may also gain from the depreciation of the U.S. dollar.

Based on our expectations (based on tactical asset allocation), the fund of the month may outperform in the near future.

VIG MoneyMaxx Emerging Market Absolute Return Investment Fund

ESG theme of the month: A step backwards in climate policy – the global consequences of the US decision

At the beginning of the year, the White House announced that President Donald Trump would withdraw the United States from one of the most important international climate agreements, considered the cornerstone of cooperation against global warming. The decision is another significant step in the Trump administration’s climate policy shift, which deliberately breaks with the multilateral approach of recent years[1][2].

Under the order, the United States will withdraw not only from the United Nations Framework Convention on Climate Change (UNFCCC), but also from 65 other international organizations. Most of these organizations deal with climate protection, clean energy, sustainable development, gender equality, and other issues that the administration considers “contrary to the interests of the United States.”

A significant number of the organizations concerned are linked to the UN system. These include the Intergovernmental Panel on Climate Change (IPCC), which is the most important professional body in global climate science, as well as UN programs and agencies that deal with reducing deforestation, energy and water management, ocean protection, and the sustainability of human settlements.

The current decision is in line with previous executive orders signed by Trump last year to dismantle federal climate policies and reverse international commitments made under Joe Biden’s presidency. Trump began his second term by once again withdrawing the United States from the 2015 Paris Agreement, which aims to keep global warming below 1.5-2 degrees Celsius.

In March 2025, the US government also withdrew from the board of directors of an UN-backed fund set up to address the damage caused by climate change. On the same day, a government official openly criticized the UN’s sustainable development goals, which include eradicating poverty, promoting gender equality, and taking immediate climate action.

The decision sparked sharp international reactions. According to Simon Stiell, Executive Secretary of the UNFCCC, the US move will harm its own citizens and economy in the long run. He said that while most countries in the world are moving forward together in addressing climate change, the US’s retreat from global leadership, science, and cooperation will inevitably damage the country’s economic prospects, jobs, and standard of living[3].

The UNFCCC is also responsible for organizing the annual UN climate summit (COP). The Trump administration did not send an official delegation to the most recent summit in Brazil, which drew serious domestic and international criticism. California Governor Gavin Newsom called the lack of US participation in COP30 “shameful,” emphasizing that it gave China room to act as a key player in global climate policy.

Under the decree, the United States will withdraw from the following organizations, among others: the International Energy Forum, the International Solar Alliance, the International Renewable Energy Agency, the International Union for Conservation of Nature (IUCN), and a total of 66 other international organizations.

The United States’ withdrawal from global climate and sustainability cooperation is not just a diplomatic gesture but could also be a spectacular sign of the transformation of the world order. As the effects of climate change become increasingly tangible, Washington is deliberately pushing multilateral solutions into the background, thereby not only reducing its international influence but also limiting its own economic and social room for maneuvering. The question is no longer whether the world will continue to cooperate on climate protection, but at what cost the United States will remain outside of it.

This could pose a serious structural challenge for Europe, as it weakens the rules-based multilateral order on which the EU relies heavily. The decision could undermine global climate and environmental cooperation, cause significant funding gaps in international institutions, and make it more difficult for Europe to assert its interests in global governance. All of this could force European countries to rethink their strategies and foreign policy frameworks.

[1] Mirza, Z. (2026, January 9). Trump pulls US from key climate treaty, 65 other global organizations. ESG Dive. https://www.esgdive.com/news/trump-pulls-us-from-climate-treaty-unfccc-65-other-global-organizations/809236/

[2] Withdrawing the United States from International Organizations, Conventions, and Treaties that Are Contrary to the Interests of the United States. (2026, January 7). The White House. https://www.whitehouse.gov/presidential-actions/2026/01/withdrawing-the-united-states-from-international-organizations-conventions-and-treaties-that-are-contrary-to-the-interests-of-the-united-states/

[3] United Nations Climate Change. (2026). Step back from climate cooperation will hurt U.S. economy: Statement from UN Climate Chief on U.S. withdrawal from UNFCCC. Unfccc.int. https://unfccc.int/news/step-back-from-climate-cooperation-will-hurt-us-economy-statement-from-un-climate-chief-on-us

This is a distribution announcement. Detailed information is needed to make a well-founded investment decision. Please inform yourself thoroughly regarding the Fund’s investment policy, potential investment risks and distribution in the Fund’s key investment information, official prospectus and management regulations available at the Fund’s distribution outlets and on the Asset Management’s website (www.vigam.hu). The costs related to the distribution of the fund (buying, holding, selling) can be found in the fund’s management regulations and at the distribution outlets. Past returns do not predict future performance. Please note that in comparison with other investment funds, the return achieved may be affected by differences in the reference index and therefore the investment policy.

The future performance that can be achieved by investing may be subject to tax, and the tax and duty information relating to specific financial instruments and transactions can only be accurately assessed on the basis of the individual circumstances of each investor and may change in the future. It is the responsibility of the investor to inform himself about the tax liability and to make the decision within the limits of the law.

The information contained in this leaflet is for informational purposes only and does not constitute an investment recommendation, an offer or investment advice. VIG Asset Management Hungary Closed Company Limited by Shares accepts no liability for any investment decision made on the basis of this information and its consequences.

The Asset Management’s license number for managing alternative investment funds (AIFM) is: H-EN-III-6/2015. The Fund Manager’s license number for UCITS fund management (collective portfolio management) is: H-EN-III-101/2016.