House View – April, 2024

Strong America

The New York stock exchange spiked last month on the back of a report from the US Department of Labor showing stronger-than-expected jobs market data. It appears that companies over the pond have shifted up a gear, hiring 303,000 new employees in March, many more than the expected 200,000 (most of them, 72,000, in the healthcare sector). This has reinforced the view that the US economy remains healthy: a strong labour market means rising disposable incomes, and this in turn is likely to boost corporate earnings. That’s good news, even though rising purchasing power could lead to higher prices in stores and higher inflation could delay the Federal Reserve’s much-anticipated rate cut.

Equity market news

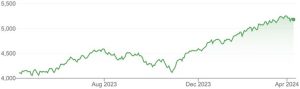

The macroeconomic backdrop assures a supportive environment for equity investments in America: the S&P 500, which tracks changes in average prices on the New York stock exchange, rose 10% in dollar terms in the first quarter. While until recently the stock market rally has been fuelled chiefly by expectations of rate cuts (because cheaper credit boosts the economy), the main driver of price increases going forward may instead be growth in corporate revenues and profits. The economy may, after all, be entering a growth phase: as already mentioned, the jobs market is strengthening, salaries and purchasing power are increasing, and this could in turn be reflected in company earnings. Also, a much wider range of companies are seeing gains on the stock markets than before: while until recently it was mainly shares in AI-related companies that were rising, investors are no longer only buying FAANG stocks. Corporate earnings are improving in Asia too: there, Korean and Taiwanese chip manufacturers are the big winners in the AI craze, and so it may be worth thinking about switching out of some Central European stocks into these.

The S&P 500 US stock index over the past year*

April is usually a good month for the stock market in America. Although past performance cannot be used to draw firm conclusions about a stock’s future behaviour, a look at seasonal patterns can provide useful insight into how stocks tend to perform at certain times of the year. Since 1945, April and December have traditionally been the best performing months of the year for stocks, with average returns of 1.6%, as it’s a time when many investors get tax refunds, which they then typically invest in the stock market.

Bond market news

It’s looking like an increasingly good time to enter the Central European bond market. On the one hand, bond yields have recently spiked – which was mainly a healthy correction following the sharp declines of the last half-year, but at the same time, strengthening inflationary fears experienced around the world have also contributed to this. The Czech 10-year government bond was still paying 5% in October 2023, which fell to almost 3.5% by February, and is now just over 4%. Similar price patterns were observable in Hungary (where yields rose from 5.5% to 7%) and in Romania (6.25% to 6.75%); however, disinflation may continue, and with more interest rate cuts in the offing, these bonds may appreciate again.

American government bond yields have also increased, but here some caution is advisable. Ten-year Treasury yields have risen to a high not seen since November 2023 and are approaching the 4.5% mark, which many investors see as a psychological limit as to whether interest rates will again reach the 2023 highs.

The US economy is stronger than expected (see above for a more detailed discussion), the probability of higher inflation is increasing, and the chance of a fall in interest rates is decreasing: instead of three, as it had expected previously, the Federal Reserve now only expects two to actually come about. Thus, speculating on appreciation is no longer so appealing.

Alternative investments

For the time being, gold seems unstoppable: the world market price per ounce (31.1 grams) will soon be nudging $2,400. It may be worth investing through the commodities markets too, as even in dollar terms, investors have enjoyed a 15% gain on the precious metal this year. The new historical high has been fuelled mainly by central bank purchases: China increased its gold reserves for the 17th month in a row in March, according to statistics from the World Gold Council. Gold tends to be more attractive during times of instability, when investors are shifting their money into perceived safe havens as a hedge against a worsening economy, geopolitical tensions or inflation, and when interest rates are falling. Copper is also becoming more expensive, and the price of industrial metals in general is rising in line with the increase in economic activity.

INVESTMENT OUTLOOK

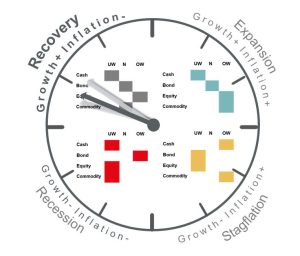

Investment Clock*

Based on our Global Investment Clock model, which connects economic cycles to investment asset classes, we are currently in the Recovery phase. In this phase, riskier assets tend to perform better than usual. At the same time, the rise in oil prices means upside risk in terms of inflation and in turn, lowers the chances of interest rate cuts. Changes in economic activity in the major regions (USA, EU, China) differed in its trajectory.

Source: VIG AMHU, based on data as at 8 April 2024

The hand of the clock indicates which economic cycle we are currently in. The fainter indicators reflect the previous situation.

OW: The investment assets that are likely to do well in the given period.

N: The investment assets that are likely to do less well in the given the period.

UW: The investment assets that are not likely to perform well in the given the period.

*The first version of the Investment Clock was introduced by the US banking house Merrill Lynch, and the current model is an enhanced version of VIG Asset Management. The model shows our current place in the world economic cycle. Our portfolio managers use forward-looking indicators in respect of both growth and inflation to identify the expected behaviour of the economy and investment assets accordingly.

** Typical performance of investment assets in the given phase of the economic cycle:

Tactical Asset Allocation

Low inflation currently favors stocks, which is a difference compared to the previous cycle, since then mainly AI stocks have pulled the indices. Now regional shares and bonds are given more weight in the portfolio. The international perception of the country has turned negative, so it is expected that the HUF will weaken further.

The table is based on our Investment Clock and quadrant analysis***.

***Quadrant models help us identify investment target markets with the best prospects. Quadrant combines the tools of fundamental and technical analysis and also takes into account macroeconomic conditions, valuation indicators, the technical picture and sentiment factors (i.e. long- and short-term drivers).

The weightings show the assessment for the given country, region and asset class, which gives the portfolio managers a basis for structuring the portfolios and creating the positions to be taken, thus helping to take advantage of the opportunities offered by the markets.

The weightings show the assessment for the given country, region and asset class, which gives the portfolio managers a basis for structuring the portfolios and creating the positions to be taken, thus helping to take advantage of the opportunities offered by the markets.

Weights:

- HU- Heavily underweight

- U – Underweight

- SU – Semi underweight

- N – Neutral

- SO – Semi overweight

- O – Overweight

- HO – Heavily overweight

Changes – change from the previous month

Focus funds

VIG Emerging Market ESG Equity Investment Fund

The Fund achieved a return of 4% in March, which was almost the same as the benchmark. The Fund maintained a slight overweight during the month, overweighting the regional (Polish and Hungarian), Greek, Indian, Korean and Taiwanese markets. In contrast, it was underweight in the markets of Thailand, Malaysia and Indonesia. The Korean and Thai overweight worked in its favour, though this was offset by the underperformance of the regional and the Greek markets. The Fund did not significantly change its regional allocation during the month, and started the new month with a slight overweighting of riskier exposures.

VIG Opportunity Developed Markets Equity Investment Fund

The Fund achieved a positive return and outperformed the benchmark. During the month, we sold the gold and silver mining positions when the price of gold reached a new high. Despite the sale, we remain bullish on these asset classes long term, but believe prices have risen too fast and too far. If there’s a drop in the price of gold and silver, we intend to buy into these assets again for the Fund. We maintain our NVDA short position as we believe that while AI is likely to be very important in the future, the company’s stock price has risen far in excess of even the most optimistic projections. During the month, we bought put options on SMCI shares, which we sold soon after when the value of the option had risen more than 30%. We’re neutral on the markets generally: we’re waiting to see what the reaction will be to the US central bank’s cutting of rates.

VIG Developed Markets Government Bond Investment Fund

During the month, we exchanged two-thirds of the euro-denominated Raiffeisen bonds expiring in 2028 for bonds maturing in 2030, and we did a similar swap in euro-denominated Romanian government securities. We sold our long-term French government securities positions and bought Italian government bonds instead. Meanwhile, we remained positive on developed market bonds.

VIG Megatrend Investment Fund

In March, the popularity of the stock markets continued to soar, with both the US and the European stock market indices reaching new highs, and the Fund also performed well in the last month. The rise in the stock markets is increasingly showing signs of broadening: it hasn’t just been the share price of AI-related stocks that have been growing; indeed, the S&P 500 index is actually outperforming the tech-heavy NASDAQ this year. The past month was more about the performance of the cyclical sectors, with the energy, raw materials and financial sectors all having an outstanding March, while IT stocks did not generally post any further gains that month. The main theme of the Fund is still AI-related, but we’re also confident about the performance of companies engaged in other industries, such as infrastructure, water management, healthcare innovation and uranium mining.

VIG Developed Markets Short Duration Bond Investment Fund

During the month, we did not significantly alter the composition of the fund, but overall we remained positive on the asset class.

ESG THEME OF THE MONTH: OUR VIG SOCIALTREND AND INNOVATIONTREND ESG FUNDS

How are we ensuring ESG compliance for our newly launched ESG funds, VIG SocialTrend and VIG InnovationTrend Funds?

- We check whether the target company is included in the exclusion list used by VIG Asset Management (i.e. the exclusion list for SFDR Article 8 funds). We avoid investing in companies whose activities are considered harmful according to international standards, including non-compliance with the principles of the UN Global Compact, involvement in controversial weapons manufacture, companies with exposure to thermal coal, and companies involved in the tobacco industry.

- We look at the company’s ESG rating, and we do not buy shares in companies that have scored below CCC, as these are regarded as industry laggards in ESG terms.

- Overall, we aim to achieve a high overall ESG score for our portfolio and to maintain at least an “A” rating in respect of annual weighted average asset allocation.

- Companies involved in controversial legal cases are rejected – a very important filter. If, for example, a company is a defendant in a lawsuit concerning local communities, it is doubtful whether we would include it in these funds.

- The Funds limit exposure to companies without an ESG rating to 20%.

How do we contribute to the achievement of ESG objectives through our newly launched VIG InnovationTrend Fund?

The Fund has the possibility to contribute to technological progress in society through innovation-themed investments. It can therefore contribute to the emergence of new products and services that make people’s lives more efficient and convenient.

Investing in e-mobility and battery technology companies can contribute to reducing carbon emissions and promoting sustainable transport.

The development and use of innovative technologies can create new jobs, especially for highly skilled professionals, while the diffusion and availability of such technologies can facilitate infrastructural and economic development in developing countries.

How do we contribute to the achievement of ESG objectives through our newly launched VIG SocialTrend Fund?

The VIG SocialTrend Fund can, among other things, contribute to the emergence of new healthcare innovations through healthcare-related investments. Innovations driven by the exigencies of population growth are transforming how patients are cared for, making healthcare systems around the world more accessible, personalised and efficient. Service providers are developing new technologies and looking for new ways to improve patient outcomes and reduce overall costs. However, social evolution is not only affecting medical treatments. Consumer habits are also changing significantly, and these are making people’s lives more comfortable.

Legal information

This is a marketing communication. To ensure you make a well-founded investment decision, you should inform yourself thoroughly about the fund’s investment policy, the possible risks of the investment and the dealing charges from the fund’s key investor information document, official prospectus and management regulations, all of which are available at the fund’s points of sale and on the company’s website (www.vigam.hu). Past performance cannot be relied on as a guide to future performance. The future yield achieved through the investment may be subject to tax. The tax and stamp-duty implications associated with specific financial instruments and transactions can only be accurately assessed in light of the individual circumstances of each investor, and these may change over time. It is the responsibility of the investor to enquire about the tax implications of the investment. The data contained in this communication is intended for information purposes only and does not constitute a solicitation to invest, a recommendation to buy or sell, or investment advice. VIG Befektetési Alapkezelő Magyarország Zrt. accepts no liability for any investment decision made on the basis of this communication or for the consequences of such decision.

Always at your disposal.

Monday 8-20h